What is Rules Engine and Why Do You Need It?

Business Rules Engine is projected to grow with a CAGR of 6,60% over the next 5 years [1]. BRE market was valued at $1.0 billion in 2020 and it's projected to reach $1.8 billion value by 2025 [4].

What is a Rules Engine?

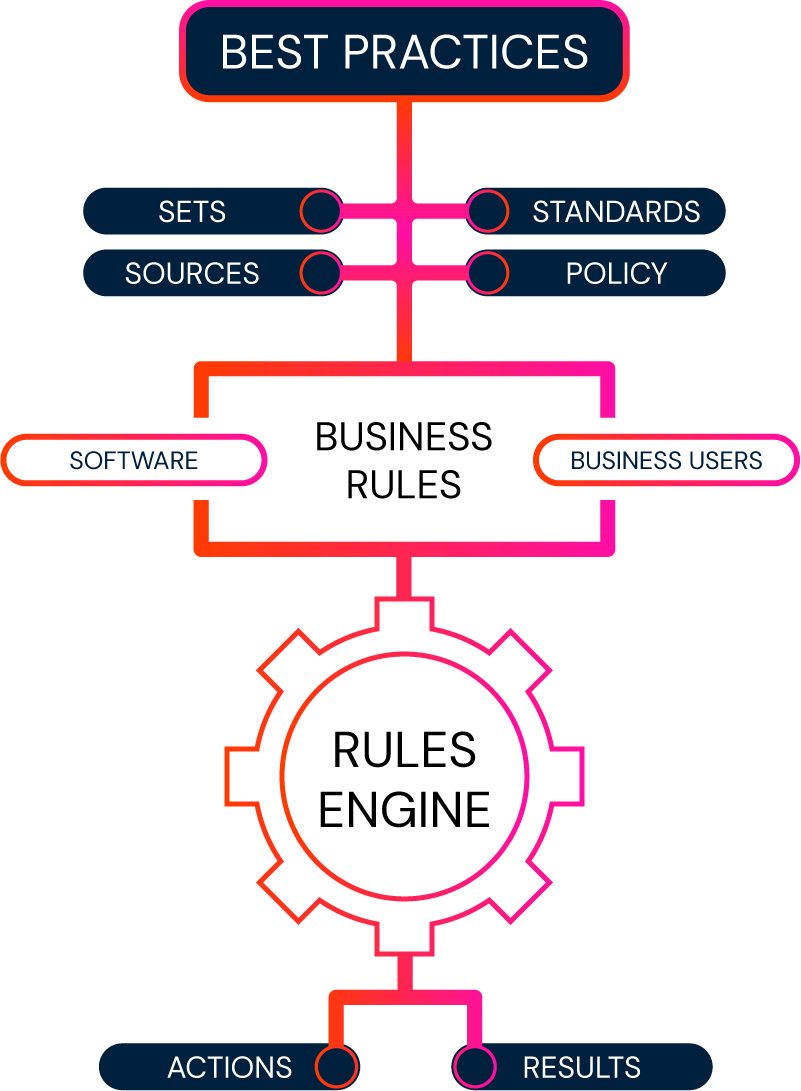

A rules engine is a flexible piece of software that manages business rules. Think of business rules as “if-then” statements. So, a basic example of a rule would be, “If A, then B, else if X, then do Y.”

These straightforward but powerful conditional statements determine how an organization operates by evaluating whether or not a given input meets certain criteria.

Rules determine what an organization can and can't do. So, when a business rules management system applies rules to a data set, it provides a true or false result depending on whether the input data matches that rule.

For example, an insurance company might have the following rule: if a new customer is under 30 years old, and has never been in a car accident, then offer a 10% discount. This is a simple example of rule creation.

Your system can use any number of rules to optimize your processes.

Use Cases of Rules Engines

Laws, regulations, business goals, best practices, and performance requirements can all be expressed by rules.

Common real-life business rules examples include:

- An insurer determines whether a candidate meets eligibility requirements.

- A bank reviews a loan application to ensure that all the requirements relating to credit and cash flow history, collateral, and character requirements are met.

- A retailer decides which customers get free shipping and a 5% discount.

A rule engine automates repetitive and complicated tasks, increases collaboration, and cuts down on expensive mistakes.

Immediate Benefits Of Rules Engines

A rule engine can have a transformative effect on a company.

One of the major advantages of a rule engine like Higson is that it enables users to modify business logic without touching the application's code.

Non-technical users can manage a company's intellectual property and critical processes without having to plow through hundreds of thousands of lines of code.

Rule engines dramatically shorten the time it takes users to make changes —from months to a matter of minutes.

Business rules engines empower business users to create rules, which means that new products have a significantly shorter time to market!

Let's see how all the important features of rules engines translate into benefits for different types of organizations.

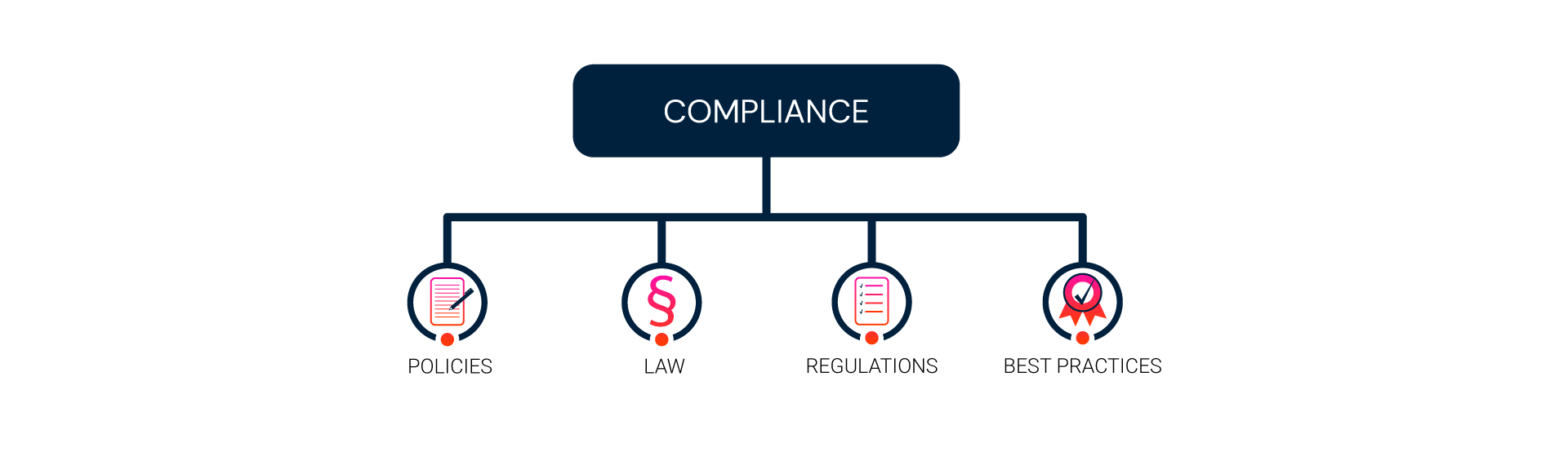

Compliance

A pressing issue facing companies across various industries is more regulatory scrutiny. Non-compliance can result in harsh fines and business disruption.

Compliance costs consist of everything necessary to keep a business compliant with relevant regulations. To do so, organizations must keep track of internal policies and local and international industry regulations.

Rules can improve compliance by making processes transparent and creating audit trails. Compliance officers use rules to make necessary changes to business decisions so their organizations can effectively respond to changing regulatory policies.

No More Repetitive and Manual Tasks

Recent studies show that repetitive and manual tasks cost companies $5 trillion a year globally [2]. Office employees spend on average 69 days per year on mundane work. These time-consuming tasks can easily be streamlined with a reliable business rule engine.

A rule engine allows employees to focus on creative work that actually merits human attention. Most rule engines can be integrated with customer relationship management software (CRMs) to reduce manual data entry.

High-Quality Work with Rules

Humans are fallible but machines aren't. A rule engine has clear instructions that define each step, which gets rid of mistakes. By eliminating errors, teams can work more confidently and innovate quicker.

Customer Segmentation Using a Rule Engine

Consumers are looking for more thoughtful and engaging businesses. Perhaps one of the most important differentiating factors for companies is their ability to segment customers.

Consumers want to do business with brands that understand their needs and deliver exceptional tailor-made results. By creating relevant offers that provide high-value experiences, businesses can secure customer loyalty.

This allows them to cater to the needs of a wide range of customers. For example, marketing teams can segment their audience based on their level of interaction with the business. This would allow them to tailor their ad campaigns accordingly.

Customer segmentation also helps companies identify new prospects with similar traits

Rules Engine: Insurance Industry

Insurance is a highly personalized industry that constantly creates new products and offers. However, not all insurance providers offer the same products or target the same audience.

Each type of insurance policy considers different factors when deciding whether to issue a plan or not. For example, auto insurance companies look at the applicant's driving history, experience, and skills.

They also need to examine the value of the vehicle and its safety record to approve an application. Life insurers consider an applicant's personal health, age, lifestyle, and family medical history.

An increasing number of insurers use rules to streamline the application process with automated insurance underwriting.

Build Insurance Segments with A Business Rules Engine

Insurers need to provide personalized services to meet customer expectations.

An insurer might segment their audience into “budget-conscious” and “agent loyal” groups. Customers who are in the former group are characterized, mainly, by their desire for minimal coverage and determination to find the “best deal.”

Conversely, customers who are in the “agent loyal” segment feel strong loyalty to their agents and value highly personalized services. Therefore, the insurer would have to come up with different products and services to effectively engage both segments.

Organize Tasks with A Rule Engine

Some of the critical tasks that major insurers perform using rule engines include:

Insurance agents use Higson to calculate plans and offer customized solutions in real-time. They can quickly search, view, and edit individual rules.

Fraud prevention

Frauds steal from American customers more than $300B each year, with every 1/10 claim in property-casualty insurance being a fraud attempt [3]. Business Rules Engines (BREs) play a crucial role in fraud prevention within the insurance industry. By automating decision-making processes, BREs help insurers quickly identify and respond to potential fraudulent activities.

They process vast amounts of data, applying business rules to flag inconsistencies or suspicious patterns indicative of fraud. This capability significantly reduces the manual effort required to detect fraud, allowing insurers to act swiftly and minimize losses.

The integration of BREs in fraud detection strategies enhances the accuracy and efficiency of the process, ensuring compliance and protecting both the insurer and policyholders from fraudulent claims.

Rules Engine: Banking & Finance

Financial institutions face tighter budgets and higher pricing pressure. This inevitably eats into their profit margins. Meanwhile, the competition to attract, engage, and increase profitable customer relationships is stronger than ever before.

In this environment, financial institutions rely on rule engines to operate efficiently and remain competitive. Banks use rules to develop new financial products while maintaining pricing accuracy and compliance.

Tasks Performed by Rule Engines

Rules engines can empower financial institutions to streamline important processes such as:

- Product Eligibility

- Credit Scoring

- Data Validation

- Cross-sell and Upsell Opportunities

Also, rule engines remain a powerful tool that effectively prevents fraud by allowing organizations to quickly react to new data.

Rule Engine as a Fraud Prevention Solution in banking

If fraudulent behavior is traced back to a particular location, then a company can immediately block all orders from that place.

However, financial institutions can also use this tool to remain proactive and prevent new schemes.

For instance, a bank could be aware of a developing trend in fraudulent behavior. A fraud analyst can simply create a rule in a rules engine that would detect this particular scheme.

Our team at Higson has implemented safeguards that let users see how each rule affects the organization without making any actual changes. You tinker with rules on a daily basis, so it's important you can do so safely.

Rules Engine: Retail

To compete retailers must enter new markets while improving their range of products. Therefore, they need to keep track of their supply chain and meet consumer demand at the same time.

A business rules engine can also be deployed as a recommendation engine for e-commerce businesses. This allows online retailers to make highly personalized product suggestions to visitors at crucial stages of the customer journey to drive more revenue.

Rules engines enable retailers to update their rules daily, which helps them to achieve their various business goals seamlessly. For example, the shipping price could change every day due to the changes in shipping fees. Retailers can't wait days or weeks to make these sorts of changes to the system.

All of these demands translate into a vast amount of information a retailer has to maintain:

- Provide consumers with customer-centric product information

- Add new items and update existing ones

- Streamline supplier approval process

- Set immediate responses to price changes

This is why major retail companies use rules to leverage the power of their data to implement a dynamic pricing strategy.

Interestingly, the retail industry has a notoriously poor track record of managing rules. It was quite common for business rules to be written on paper. Unsurprisingly, rules would often be misplaced or lost!

Luckily today retailers that use business rules management solutions can manage their business decisions and all their knowledge in one accessible place.

Other industries that could benefit from using Business Rules Engines

Business Rules Engines (BREs) can benefit various industries beyond banking and insurance. Here are a few examples:

- Healthcare - For managing patient data, treatment protocols, and compliance with healthcare regulations.

- Manufacturing - To streamline production processes, quality control, and supply chain management.

- Telecommunications - For managing service provisioning, billing, and customer service operations.

- E-commerce - For personalization, recommendation engines, and dynamic pricing strategies.

- Government and Public Sector - To improve public services, regulatory compliance, and resource allocation.

- Transportation and Logistics - For route optimization, fleet management, and regulatory compliance.

- Education - For personalized learning plans, administration, and compliance with educational standards.

- Human Resources - BREs can be used for automating various HR processes like recruitment screening, employee onboarding, benefits administration, and compliance with labor laws. They help in standardizing HR policies across the organization and ensuring fair and consistent application of these policies.

Each of these industries can leverage BREs to automate decision-making processes, enhance operational efficiency, and comply with industry-specific regulations.

Most business rules engines today are designed to not only automate complex decision-making processes but also to empower different departments within an organization. They are no longer just tools for IT specialists; they serve as bridges between technology and business strategy. A well-chosen BRE aligns with both your current operational needs and your strategic goals, enabling departments like HR, Finance, and Sales to efficiently execute mission-critical processes. The right BRE transforms the way your organization responds to challenges and leverages opportunities, making it an integral part of your business's growth and adaptability in a dynamic market

The ideal rule engine for your organization depends on the set of rules you need to implement and your specific goals.

Mission-critical processes take place in departments like HR, Finance, Procurement, Administration, and Sales and can be optimized with a rule engine.

What you should look for when choosing a BRE:

- Ease of Use - The BRE should have an intuitive interface that allows non-technical users to create and manage rules easily.

- Integration Capabilities - Ensure the BRE can integrate seamlessly with your existing IT infrastructure and data sources.

- Scalability - The BRE should be able to handle increasing volumes of data and complexity of rules as your business grows.

- Performance and Speed - Assess the engine's ability to process rules quickly and efficiently, especially for real-time decision-making needs.

- Customization and Flexibility - The BRE should be adaptable to your specific business needs and rules.

- Support and Maintenance - Consider the level of customer support and maintenance services provided.

- Compliance and Security - The BRE must adhere to industry standards and regulations, especially regarding data privacy and security.

- Cost - Evaluate the total cost of ownership, including licensing, implementation, and ongoing operational costs.

- Vendor Reputation and Reviews - Research the vendor's market reputation and read customer reviews to gauge reliability and customer satisfaction.

There are also some pitfalls to avoid:

- Overlooking the BRE's compatibility with your current systems.

- Neglecting the importance of user-friendliness for non-technical staff.

- Underestimating the total cost of ownership.

- Ignoring scalability which could lead to performance issues as your business grows.

- Failing to consider the long-term support and maintenance requirements.